Can stocks go higher?

The stock market rocketed to new record highs after the latest Federal Reserve meeting.1

Will markets continue to rise?

Will stocks take a dive after the recent record highs?

What could the Baltimore bridge collapse mean for the economy?

Let’s discuss.

Why are stocks on such a tear?

Despite some bumps in the road, markets have been on an extended rally that has gone on for months, notching new record highs along the way.1

Two major factors are fueling the gains:

1. The expectation of interest rate cuts (soon)

2. Enthusiasm for tech and AI stocks

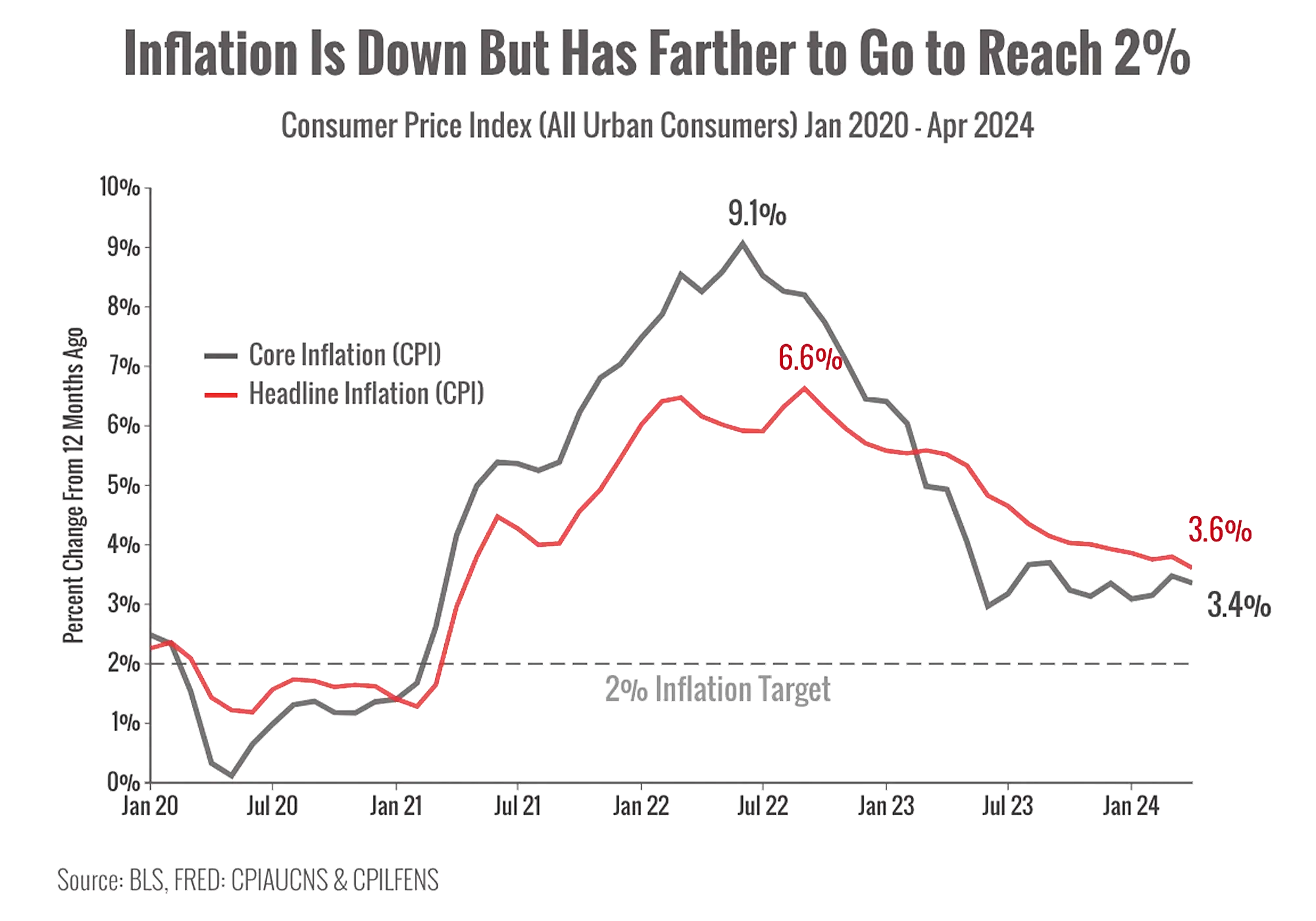

The latest Fed meeting ended with investors concluding that policymakers are serious about cutting interest rates this summer (as long as inflation data continues to trend downward).2

The Fed's official position is that it expects to cut rates at least once this year (some Fed officials want to cut rates two or even three times).3

Investors expect lower rates to bolster the economy by making it cheaper and easier for consumers and businesses to spend, build, and grow.

Will stocks continue to rally?

Many analysts think there’s still plenty of room for stock prices to rise this year because they believe the rally is fueled by expectations of healthy economic growth.

The chart shows some analysts' 2024 year-end forecasts for the S&P 500 index.4

While you can see a few analysts are less bullish than the others, many are predicting a strong year for stocks.

Will they prove correct? We'll have to wait and see.

Is a correction coming?

Corrections are always possible, especially after markets reach new highs.

Much of the current rally’s steam comes from expecting interest rates to fall soon.

We should expect a pullback if inflation data comes in hotter than expected or traders think the Fed might be getting cold feet.

Technology stocks (another pillar of the rally) are also typically interest-rate sensitive since many tech companies rely on debt to fund operations (and may not produce immediate profits).

Could the Baltimore bridge collapse impact the economy?

It's not yet clear the extent to which the sudden bridge collapse and port shutdown could impact supply chains or inflation.

It's also hard to fully reckon the human tragedy of lives lost when the bridge fell, and lives disrupted by the aftermath.

The Port of Baltimore is one of the busiest ports on the East Coast, and is a major hub for coal, sugar, and vehicles.6

The port's closure may impact global coal prices as well as supply chains for cars, trucks, and other goods.

We'll know more in the weeks and months to come.

Bottom line: The rally is looking healthy and could continue, but we expect pullbacks as investors take profits and digest new data.

As always, we’re watching and preparing for the different scenarios that could play out this year. Don’t hesitate to reach out if you have any questions.

Sources:

1. https://www.cnbc.com/2024/03/24/stock-market-today-live-updates.html

2. https://www.cnbc.com/2024/03/20/fed-meeting-today-live-updates-on-march-fed-rate-decision.html

3. https://www.cnn.com/2024/03/26/economy/fed-officials-fewer-rate-cuts-this-year/index.html

4. https://finance.yahoo.com/news/wall-streets-most-bullish-strategist-cites-a-big-surprise-pushing-stocks-higher-morning-brief-100051265.html

5. https://www.nasdaq.com/articles/can-big-tech-stocks-thrive-in-a-higher-interest-rate-environment

6. https://www.wsj.com/finance/baltimore-bridge-economic-impact-0514d05a

Chart sources:

1. https://finance.yahoo.com/news/wall-streets-most-bullish-strategist-cites-a-big-surprise-pushing-stocks-higher-morning-brief-100051265.html

2. https://www.wsj.com/finance/baltimore-bridge-economic-impact-0514d05a, https://www.eia.gov/coal/production/quarterly/pdf/t13p01p1.pdf

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Registered Representative & Securities Offered Through Capital Synergy Partners, Member FINRA/SIPC , 2860 Michelle Dr. Suite 150 Irvine, CA 92606, Phone: 888-277-1974

Generations Wealth Management Group and Capital Synergy Partners are Unaffiliated Entities.